Strategic Credit Solutions for Technology Companies

Our approach is designed to support the growth and success of our partner companies and their investors

What We Do

Capital IP provides customized non-dilutive credit solutions for mid-to-late-stage technology companies.

Deep Industry Expertise

Creative Structuring Solutions

Collaborative, Long-Term Partnership

We are based in San Francisco and Scottsdale and focus exclusively on making investments in companies across North America, Europe, Australia, and Israel, primarily directed towards mid-to-late-stage technology companies in the software, hardware, data-analytics, and other enterprise and SMB focused technology sectors.

What We Provide

We provide minimally dilutive credit solutions for growing technology companies. Our solutions have a lower cost of capital than venture or growth equity and unlike traditional venture debt, do not require concurrent equity investment.

Extend runway

Align incentives

Provide financial and operational flexibility

Maximize value for all stakeholders

Our customized solutions enable management teams to invest efficiently in growth initiatives, product development, sales and marketing, and other long-term objectives designed to ensure operational and financial flexibility.

Growth Capital

Recapitalizations / Refinancings

Acquisition Financing

Shareholder Liquidity

Capital IP has decades of experience investing and advising in the global technology industry and brings a unique and focused approach to structuring creative credit solutions within the industry context. Furthermore, this dedicated and specific experience enables us to be nimble and responsive to our partner companies as they navigate operational, market, and capital needs.

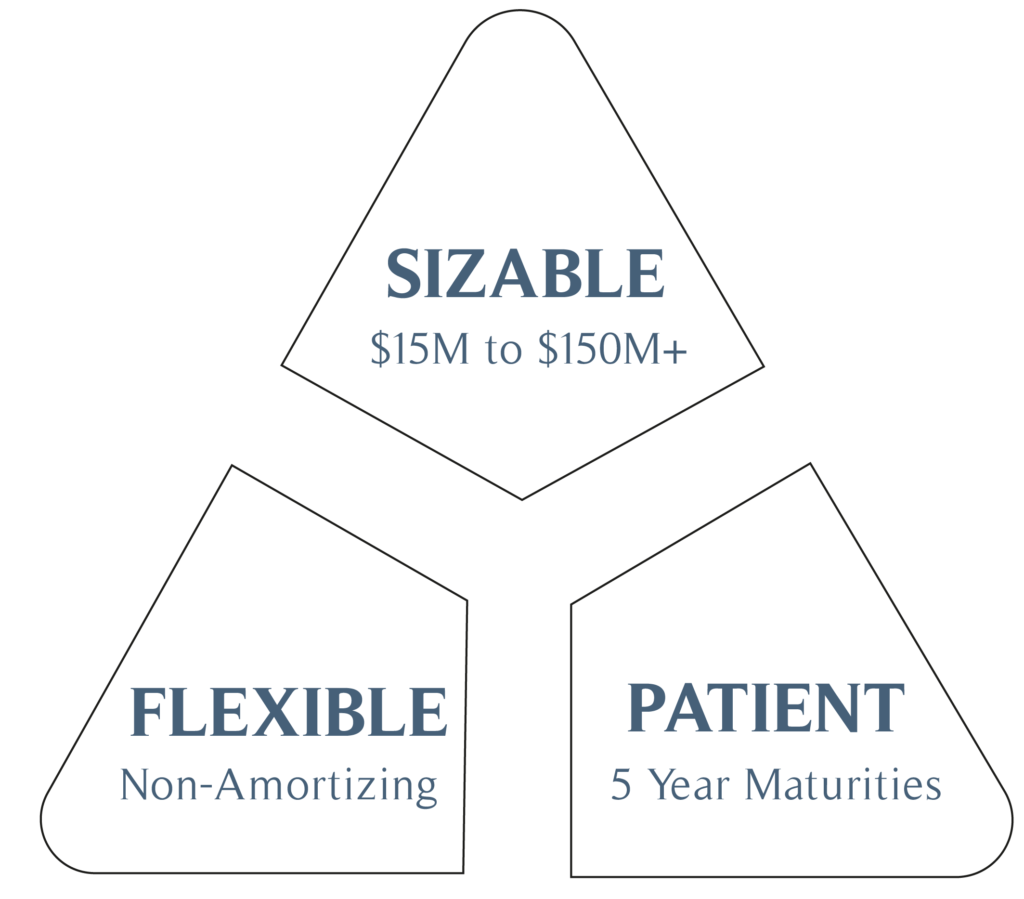

Our credit solutions range in size from $15M to $150M+ depending on the borrowing company’s financial profile and are non-amortizing with long-term maturities of typically at least 5 years.

Founders

Capital IP was purposefully built to combine senior-level tech industry expertise with creative structuring to provide uniquely flexible financing solutions for our borrowers.

Riyad Shahjahan, Managing Partner

- Former Head of Technology M&A, UBS / JP Morgan / Citigroup

- 20+ years of leadership experience in global technology investment banking

Riyad Shahjahan, Managing Partner and co-founder of Capital IP, plays a pivotal role in driving investment origination, underwriting, and portfolio management. With a background encompassing a decade of experience in private credit investing within the technology sector, Riyad has successfully navigated the landscapes of both US and European mid-to-late-stage companies. Riyad’s dual expertise in investing and M&A advisory positions him as a valuable resource for our portfolio companies. His deep-rooted relationships with CEOs, CFOs, Board Members, investors, and bankers further amplify Capital IP’s capacity to be a true strategic capital partner to our borrowers.

Aron Dantzig, Managing Partner

- Former Co-Head and Managing Director of the Life Sciences Group for the Drawbridge Special Situations Fund at Fortress Investment Group

- Extensive experience structuring credit investments to mid-to-late-stage growth companies

Aron Dantzig, Managing Partner and co-founder of Capital IP, brings extensive investment experience in structuring unique and creative credit solutions which provide flexible, non-dilutive capital to a variety of growth businesses. These creative financing solutions have resulted in significant savings of hundreds of millions of dollars for businesses by mitigating potential dilution risks, optimizing financial outcomes, and maximizing value for investors.

Portfolio

Capital IP has a long history as a supportive financial partner with extensive industry experience which has benefited a variety of technology businesses. Our team members have committed over $1.5B of structured investment solutions across a variety of portfolio companies, including businesses backed by traditional institutional investment as well as those “bootstrapped” by founders.

Address

1000 Brannan Street, Suite 402

San Francisco, CA 94103